TAN Registration in India – Staring From ₹ 499 + GST

Assistance with Form 49B Filing

Full Support for TDS/TCS Compliance

Transparent Pricing – No Hidden Charges

Request a call back

Real Stories from Real People

Hear how teams across industries use patron to save time, cut costs, & stay in control.

TAN Registration in India

In India’s dynamic business and taxation ecosystem, having a Tax Deduction and Collection Account Number (TAN) is critical for any entity responsible for deducting or collecting tax at source. TAN registration ensures smooth compliance with the Income Tax Department, facilitating proper reporting of TDS/TCS payments. Across India, companies, partnerships, proprietorships, trusts, and government bodies rely on TAN to avoid penalties, maintain transparency, and streamline financial operations. Whether you are a corporate office in Bengaluru, a manufacturing unit in Pune, or a startup in Gurugram, TAN registration is an essential step to ensure timely tax deduction, correct filing of returns, and adherence to legal obligations. By formalizing tax deduction practices, Indian entities can focus on growth, minimize compliance risks, and maintain credibility with financial institutions and government authorities.

What is TAN Registration?

TAN registration is the process of obtaining a unique 10-character alphanumeric Tax Deduction and Collection Account Number (TAN) issued by the Income Tax Department. This identifier is essential for entities responsible for deducting or collecting tax at source, such as companies, partnerships, proprietorships, trusts, NGOs, and government bodies. TAN is mandatory for payments, including salaries, contractor fees, rent, commission, professional fees, and other transactions where TDS/TCS applies. By registering for TAN, organizations ensure accurate tracking of tax deductions, proper credit of taxes to the government, and seamless filing of TDS/TCS returns.

Operating without TAN can lead to penalties, legal complications, and delays in processing returns, potentially affecting credibility with financial authorities. With a valid TAN, businesses and entities across India can maintain compliance, streamline their tax responsibilities, and operate with confidence, ensuring transparency in all deductions and fostering trust with employees, clients, and regulatory authorities alike.

Who Needs TAN Registration?

TAN Registration is essential for all entities responsible for deducting or collecting tax at source under the Income Tax Act. It is particularly relevant for:

- Companies, LLPs, and partnerships deducting TDS on salaries, contractor payments, rent, or professional fees.

- Trusts, societies, and NGOs responsible for TDS deductions on donations, grants, or other payments.

- Government authorities managing TDS obligations on payments.

- Individuals or businesses required to collect TCS on the sale of specified goods or services.

Proper TAN registration ensures legal compliance, accurate tax reporting, and smooth processing of TDS/TCS returns. Patron Accounting provides comprehensive support for TAN Registration, assisting you with document preparation, online filing, and timely approval, enabling your organization to meet all regulatory requirements efficiently and avoid penalties.

Eligibility Criteria for TAN Registration

TAN registration is specifically designed for entities responsible for deducting or collecting tax at source under the Income Tax Act. By defining clear eligibility standards, the system ensures that all liable entities comply with tax regulations and can file TDS/TCS returns accurately, avoiding penalties and legal complications.

Companies & LLPs

Partnerships & Proprietorships

Trusts, Societies, NGOs

Individuals

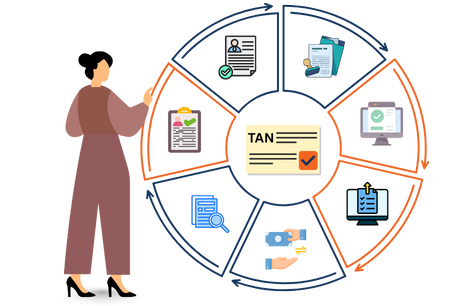

Process of TAN Registration

Determine Applicability

Identify whether your entity is required to deduct TDS or collect TCS under the Income Tax Act. This applies to companies, partnerships, LLPs, trusts, societies, and individuals making specified payments.

Prepare Documents

Collect all necessary documents, including PAN of the entity and authorized signatory, address proofs, and identity proofs. Accurate documentation is essential to avoid delays in processing.

Fill Application Form 49B

Complete Form 49B either online via the NSDL portal or offline, providing all details accurately, including entity type, address, and contact information.

Submit Form

Upload supporting documents with the online application or submit the form physically at designated NSDL facilitation centers. Ensure all documents are correctly attached to prevent verification issues.

Payment of Fees

Pay the prescribed application fees online or through demand draft/offline channels, as applicable.

Acknowledgment & Verification

After submission, NSDL and the Income Tax Department verify the information and documents. Any discrepancies may require clarification or resubmission.

TAN Issuance

Once verified and approved, a unique 10-character TAN is issued. This serves as the official identifier for TDS/TCS purposes and must be quoted in all relevant tax filings and communications.

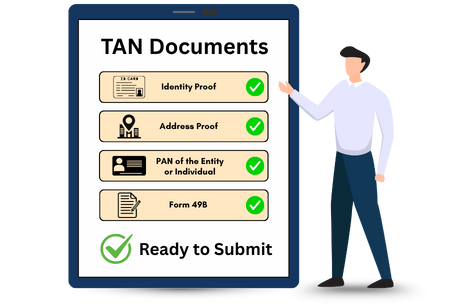

Documents Required for TAN Registration

Accurate documentation is crucial for smooth and timely TAN registration. Properly prepared documents help avoid delays, penalties, and rejections by the Income Tax Department.

-

Identity Proof of Authorized Signatory: PAN, Aadhaar, or Passport of the person responsible for managing TDS/TCS.

-

Address Proof of the Entity: Utility bill, rent agreement, or Certificate of Incorporation to verify the official business address.

-

PAN of the Entity or Individual: Mandatory for all entities responsible for deducting or collecting tax under the Income Tax Act.

-

Form 49B: The official TAN application form, duly filled and signed.

Legal Penalties for Non-Registration

Ensuring TAN registration is crucial for all entities responsible for TDS/TCS. Non-compliance can lead to substantial financial penalties, legal complications, and rejection of returns. The Income Tax Department enforces strict measures to maintain transparency and accountability in tax deduction and collection.

Violation

Operating without TAN

Failure to quote TAN in TDS/TCS returns

Misreporting or incorrect TAN usage

Penalty / Consequence

₹10,000 penalty under Section 272B of the Income Tax Act

Returns may be rejected; fines may apply

Penalties and interest on TDS/TCS amounts

Validity and Renewal of TAN

TAN is a permanent identifier for entities responsible for deducting or collecting tax at source, designed to simplify TDS/TCS compliance across India. Once issued, it remains valid for life, providing uninterrupted recognition with the Income Tax Department. Keeping TAN details updated ensures seamless tax reporting and prevents discrepancies in TDS/TCS filings.

- Validity: TAN is valid for life and does not require periodic renewal.

- No Renewal Needed: The TAN remains permanent unless there is a change in the authorized signatory or entity details.

- Update Procedure: Any corrections or updates can be submitted online through NSDL or Income Tax portals, ensuring records remain accurate and compliant.

Benefits of TAN Registration

Legal Compliance

Efficient Tax Reporting

Transparency

Penalty Avoidance

Enhanced Credibility

Types of TAN Registration

TAN registration does not have multiple categories like Udyam, but it can be applied for by different types of deductors or collectors of tax under the Income Tax Act. Selecting the correct type ensures accurate compliance and smooth tax reporting.

| Feature | Stock Audit | Internal Inventory Control |

|---|---|---|

| Company / LLP | Deducts or collects TDS/TCS on salaries, contractors, rent, or other payments. | Large organizations, corporate offices |

| Partnership / Proprietorship | Deducts TDS on payments above threshold limits | Small and medium businesses, startups |

| Trusts, Societies, NGOs | Deducts TDS on applicable payments | Non-profit organizations, charitable trusts |

| Individuals / HUFs | Deducts TDS on specific payments such as interest, commission, or contractor fees | Professionals, freelancers, and individual business owners |

Patron Accounting: Your Stock Audit Partner in India

Patron Accounting offers specialized stock audit services across India, leveraging years of experience in statutory, internal, and sector-specific audits. Our team provides:

Why Choose Patron Accounting for TAN Registration

In India’s complex tax landscape, accurate TAN registration is vital for businesses, trusts, and organizations responsible for TDS/TCS. Patron Accounting brings over 15 years of expertise, providing end-to-end support to ensure a seamless, compliant registration process. Our team guides you in selecting the correct registration category, prepares and verifies all documents meticulously, and manages the filing process with careful follow-up until your TAN is issued. Beyond initial registration, we assist with corrections, updates, and record maintenance, ensuring your entity remains fully compliant with Income Tax regulations. By partnering with Patron Accounting, you avoid costly errors, delays, and penalties while gaining peace of mind that your TDS/TCS obligations are accurately managed. Our professional, reliable, and timely services empower businesses and organizations across India to focus on operations, growth, and financial management, while we handle the technicalities of TAN registration and compliance efficiently and confidently.

TAN Registration Customised by States and Cities

TAN Registration in Delhi

TAN Registration in Gurugram

TAN Registration in Haryana

TAN Registration in Maharashtra

TAN Registration in Mumbai

TAN Registration in Pune

Frequently Asked Questions

Have a look at the answers to the most asked questions.